London hits pre-Covid peak as global markets mostly advance

News24

08 Apr 2021, 23:43 GMT+10

- World stocks mostly rose on Thursday, with London striking its highest level since before the pandemic.

- "The FTSE 100 hit its best level since the pandemic struck because there is growing confidence in the global and UK economic recovery," says an analyst.

- London's benchmark FTSE 100 index surged as high as 6 926.68 points, the highest intra-day level in more than a year.

World stocks mostly rose Thursday, with London striking its highest level since before the pandemic, with optimism boosted after the Federal Reserve underlined its commitment to record-low interest rates.

London's benchmark FTSE 100 index surged as high as 6 926.68 points, the highest intra-day level in more than a year, before paring gains.

In the eurozone, Paris and Frankfurt also advanced.

"The FTSE 100 hit its best level since the pandemic struck because there is growing confidence in the global and UK economic recovery," Markets.com analysts Neil Wilson told AFP.

Asian markets mostly rose as traders also took heart from Fed meeting minutes reinforcing its intention to keep borrowing costs at record lows for an extended period.

"Optimism surrounding the global economic recovery, supported by an accommodative Federal Reserve, lifted European stocks," said OANDA analyst Sophie Griffiths.

"The minutes from the March (Fed) meeting didn't reveal anything new, but a reiteration of the Fed's supportive stance appears to have been a tonic for the markets."

Wilson said that "the Fed's commitment to keeping short end rates down at a time of massive fiscal expansion means the path of least resistance for equities is up."

Bad news is good news

Wall Street opened mostly higher, although initial claims for US unemployment benefits unexpectedly rose to 744,000 last week, defying expectations to fall below 700 000.

The Dow opened essentially flat, but the S&P 500 added 0.3% from its record close on Wednesday.

"The key takeaway from the report is that it is disappointing labour market data that will convince the Fed that it needs to be patient before removing policy accommodation," said market analyst Patrick J. O'Hare at Briefing.com.

"That view is apt to sit just fine with the stock market, which relishes the idea that the Fed isn't going to be raising rates anytime soon," he added.

While this might not result in big gains for the stock market, "it is the idea that keeps market participants inclined to buy on weakness and the stock market levitating on rotational trading activity."

Traders also kept tabs on the progress of US President Joe Biden's huge infrastructure plan.

The prospect of another giant spending splurge, coming soon after the passage of his $1.9 trillion stimulus, has added to expectations the country is on course for blockbuster growth.

Positive outlook

For now, traders are happy to ride the rally as coronavirus vaccination programmes progress, allowing economies to gradually reopen - even if a little slower in some areas than others.

"The short-term momentum appears to remain in favour of the bulls as investors seem happy and willing to bet on an economic rebound over the coming months in light of the robust data in recent weeks," said Axi strategist Stephen Innes.

"And on top of all that, equity volatility continued to remain tepid around its lowest levels since the pandemic began, encouraging risk-taking."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Pakistan Telegraph news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Pakistan Telegraph.

More InformationInternational

SectionFaulty IT system at heart of UK Post Office scandal, says report

LONDON, U.K.: At least 13 people are believed to have taken their own lives as a result of the U.K.'s Post Office scandal, in which...

Travelers can now keep shoes on at TSA checkpoints

WASHINGTON, D.C.: Travelers at U.S. airports will no longer need to remove their shoes during security screenings, Department of Homeland...

Rubio impersonator used AI to reach officials via Signal: cable

WASHINGTON, D.C.: An elaborate impersonation scheme involving artificial intelligence targeted senior U.S. and foreign officials in...

Warsaw responds to migration pressure with new border controls

SLUBICE, Poland: Poland reinstated border controls with Germany and Lithuania on July 7, following Germany's earlier reintroduction...

Deadly July 4 flash floods renew alarm over NWS staffing shortages

WASHINGTON, D.C.: After months of warnings from former federal officials and weather experts, the deadly flash floods that struck the...

Putin fires transport chief, later found dead in suspected suicide

MOSCOW, Russia: Just hours after his sudden dismissal by President Vladimir Putin, Russia's former transport minister, Roman Starovoit,...

Business

SectionEx-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Gold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

U.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...

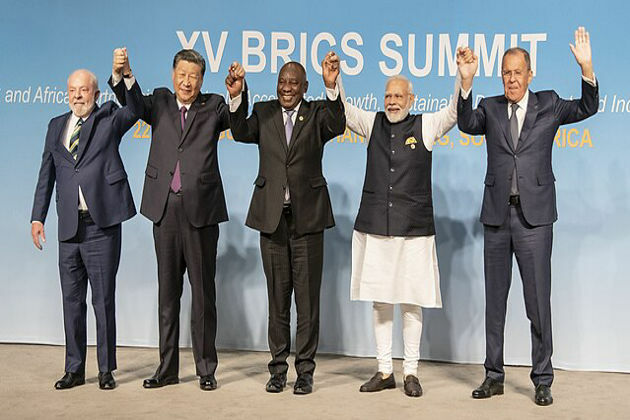

BRICS issues rebuke on trade and Iran, avoids direct US criticism

RIO DE JANEIRO, Brazil: At a two-day summit over the weekend, the BRICS bloc of emerging economies issued a joint declaration condemning...